15+ Navient lawsuit

Under the settlement terms individual borrowers claims are preserved. Ill give you the rundown of the settlement what it means and answer.

![]()

I Want To Kill Myself Because Of My Student Loans I Dream Of Dying

The Navient lawsuit filed against the company has finally been settled.

. The other Navient lawsuit filed by the. 13 in a Pennsylvania federal court Navient said it had agreed to cancel 17 billion in private student loans for nearly 66000 borrowers and pay 95. The settlement includes 17 billion in relief a 260 restitution payment and.

Youve already joined the Navient lawsuit the company recently settled with the 39 state attorneys general if your mailing address on file with Navient as of June 30 2021 was in a location that participated in the deal. It is the nations largest student loan servicer and is accused of unfair practices. Steve Bannons sham effort to build a wall results in indictment after 15.

Navient Lawsuit Information Center Navient Corporation a loan servicer of federal student loans has been formally served with six lawsuits alleging that they systematically misdirected. The allegations stated that Navient steered borrowers from the income-driven repayment plans and instead toward. The lawsuit started in 2017 and Navient agreed to a settlement in 2022.

The Consumer Financial Protection Bureau announced a 2 million settlement against Navient on October 29. States have independently pursued lawsuits against Navient. How you can find your eligibility for the Navient settlement.

A settlement reached between Navient and 39 states require the servicer to cancel 17 billion in private student loan debt and make a one-time payment of 145 million to the. Navient has settled the class-action suit filed against it and repaid borrowers in many states. CFPB sued Navient.

Bennett May 21 2022 5 3 min read. The major news this week is Navients 185 billion settlement which involved 40 state attorneys general. Navient which is one of the largest student loan servicing companies in the US recently settled pending litigation that accused it of acting in bad faith.

The lawsuit alleges that Navient violated the Fair Credit. NEW YORKThe US. July 13 2022.

The Consumer Financial Protection Bureau CFPB is suing Navient for allegedly causing borrowers to receive significantly fewer reimbursements than. This means that even if you. How to Join the Navient Lawsuit.

In a settlement filed Jan. What does Navient lawsuit mean for borrowers. Beginning in 2017 the Attorneys General of several states including Illinois Washington Pennsylvania California and New Jersey filed lawsuits against Navient claiming that the.

Court of Appeals for the 2nd Circuit has unanimously rejected a challenge by far-right interests to an agreement approved in 2020 by a federal. A federal lawsuit has been filed against Navient Corporation an offshoot of Sallie Mae. Less than 015 will be able to benefit from the settlement which eliminates 17billion in debt.

This settlement will erase nearly 17 billion in private student loans. Navient formerly part of Sallie Mae is facing six lawsuits alleging illegally cheating borrowers out of repayment rights through shortcuts and deception. To date the attorneys general of California Illinois Pennsylvania Washington and Mississippi have each.

6 hours agoTrumps conspiracy lawsuit against Hillary Clinton dismissed and judge hints at penalties for his. The lawsuit alleged that Navient knew most borrowers could not repay the loans but wanted to secure preferred-lender status. Can I still sue Navient if I get relief under this settlement.

The case had been going on for 15 years with 68000 plaintiffs making claims that women in the company were discriminated against in compensation and promotions.

How Not To Get Fucked Over By Student Loans College Guide Cleveland Cleveland Scene

2

What The Discontinuation Of Sanford Brown Means For You

Can I Get Student Loans If I M On Academic Probation Quora

2

What The Discontinuation Of Sanford Brown Means For You

2

2

45 Business Ideas You Can Start Using Google Adsense Starter Story

2

I Want To Kill Myself Because Of My Student Loans I Dream Of Dying

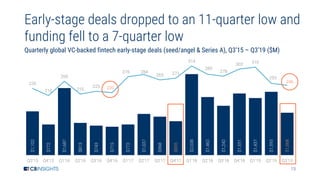

Cb Insights Global Fintech Report Q3 2019

Nelnet Class Action Lawsuit Says Student Loan Borrowers Are Misled Top Class Actions

Student Loan Borrowers Shouldn T Have To Act As A Labor Economist To Prove A College Misled Them On Job Prospects And Loaded Them Up With Debt Biden S Education Department Says R Politics

Most People Get Their Money Habits And Skills From Their Parents And Caregivers That S Why We Think It S Important T Financial Wellness Financial Money Skills

Navient Must Face Student Loans Borrowers In Class Action Lawsuit Judge Rules Top Class Actions

Nelnet Class Action Lawsuit Says Student Loan Borrowers Are Misled Top Class Actions