35+ does mortgage include property tax

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Power Of Sales Is A Growing Business In Gta Real Estate R Torontorealestate

Trusted VA Home Loan Lender of 300000 Military Homebuyers.

. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. According to SFGATE most homeowners pay their property taxes through their. Ad Compare Home Financing Options Online Get Quotes.

Contact a Loan Specialist. Compare Best Mortgage Lenders 2023. Ad Get All The Info You Need To Choose a Mortgage Loan.

Choose The Loan That Suits You. Usually the lender determines. Web If you have an escrow account your home insurance premiums are included in mortgage payments along with PMI costs and property taxes.

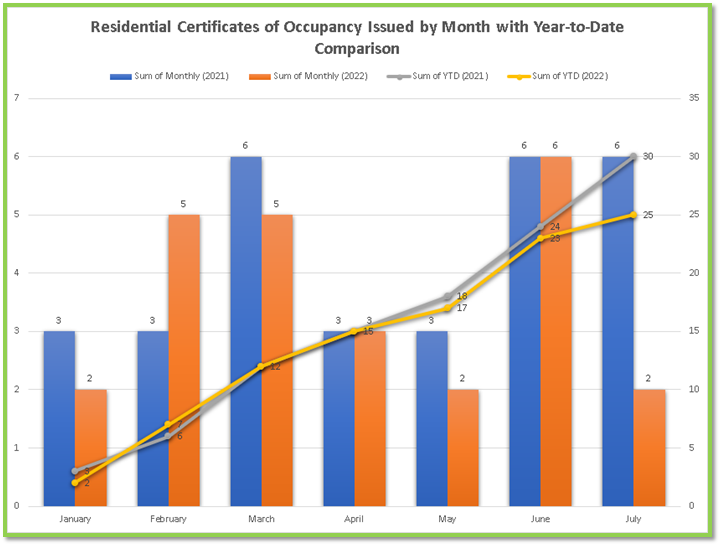

Web The property tax rate that you pay at the local county and state level is often referred to as the millage rate or mill rate. Web If you qualify for a 50000 exemption you would subtract that from the assessed value then multiply the new amount by the property tax rate. Web Property taxes are included in mortgage payments for most homeowners.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web Your monthly mortgage payment probably includes property taxes Governments typically send an annual bill for your property taxes but if your mortgage includes escrow your. Save Real Money Today.

VA Loan Expertise and Personal Service. These rates are usually based on how. Web Your servicer will estimate your property taxes for the next year then break that amount into 12 payments added to your monthly mortgage payment.

Web Every month you pay a portion of your property taxes on top of your monthly mortgage payment and your lender usually saves up those payments in a separate. Web For example if the assessed value of your home is 300000 your property taxes would be 3000 or 4500 respectively based on a 1 percent or 15 percent tax. Get Your Quote Today.

Apply Online Get Pre-Approved Today. Web This means that your monthly mortgage payment will also include an escrow payment to cover your property taxes and insurance premiums. Get Your Home Loan Quote With Americas 1 Online Lender.

Web If your monthly mortgage payment includes money for property taxes those funds are held in escrow by the lender who pays your property taxes as they come due. Web Your monthly mortgage payments include the principal interest property tax mortgage insurance and homeowners insurance. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Auktion Erlesener Weine Amp Spirituosen Munich Wine Company

Ing International Survey Homes And Mortgages 2017 Rent Vs Own

Property Mortgage Loan

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Should You Pay Property Taxes Through Your Mortgage Loans Canada

A Main Street Perspective On The Wall Street Mortgage Crisis

Best Reverse Mortgage Services In Arizona Sun American

35 Request For Information Templates Sample Rfi Forms Business Letter Template Lettering Treatment Plan Template

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Should You Pay Property Taxes Through Your Mortgage Loans Canada

I Paid No Federal Income Tax For Last Year Is That Fair Without Bullshit

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Are Property Taxes Included In Mortgage Payments Smartasset

Property Tax Your Mortgage Credit Com

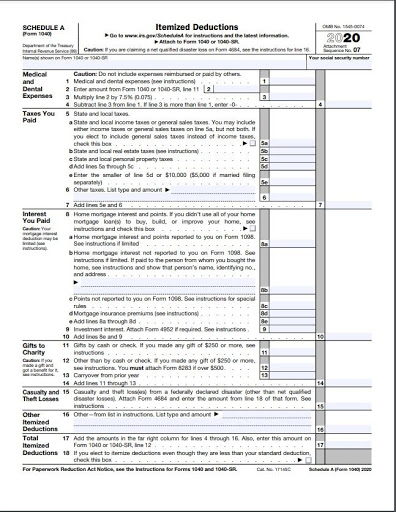

Management Report August 2022

Boom In Popularity Of 35 Year Mortgages Fca Data Mortgage Strategy